Sanz Virtual Enterprise, LLC | CPA Accounting and Tax Services

With over 20 years of experience, Sanz Virtual Enterprise, LLC has been a trusted financial partner for individuals and businesses of all sizes. We serve everyday working individuals, sole proprietorships, S corporations, partnerships, C corporations, estates, and non-profit organizations. Our experienced team offers a comprehensive range of services including CPA accounting and tax services, tax planning, bookkeeping, financial statements audits and reviews, tax resolution, budgeting, in-depth consultations, and more. Let our experienced and trusted team of experts help you navigate your financial journey with confidence. Contact Sanz Virtual Enterprise, LLC to see how our expert CPA accounting and tax planning and preparation services can help you today!

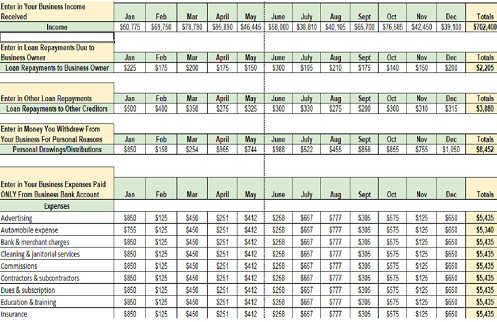

📊 Best Small Business Bookkeeping Services

Streamline your financial management with comprehensive bookkeeping and accounting services. Whether you’re just starting out or scaling your business, we handle everything from transaction recording to account reconciliation. With our detailed financial reports, you’ll gain valuable insights into your business's financial health, enabling smarter, more informed decisions.

📅 Expert Tax Planning & Preparation Services

Maximize your tax savings with expert tax planning and preparation. We specialize in both individual and small business tax services, from straightforward filings to complex strategies tailored to your unique financial situation. Our team ensures you comply with tax laws while minimizing your liabilities and taking advantage of all available deductions and credits.

⚖️ Tax Resolution for Individuals & Businesses

Dealing with tax issues like unpaid balances, unfiled returns, or penalties can be stressful. Our Tax Resolution Services help you regain control by working directly with the IRS to settle your tax debts. We offer strategies like installment agreements, offers in compromise, and penalty abatement to resolve issues efficiently and restore your tax compliance status.

My Five Sense Depot: News, Knowledge, & Tips

Top Stories in the News

Level up with top stories in the news in all things accounting, taxes, and more from around the globe. Be sure to check-in to stay abreast with recent tax related updates, changes impacting the accounting world, and more. Read more..

Solo 401K vs SEP-IRA

As an S corporation owner, you wear many hats. You’re the CEO, the marketing team, the janitor – and, most importantly, your own chief financial officer. That means when it comes to retirement planning, read more..

Testimonials

"Sanz has been doing our taxes for many years. His attention to detail, knowledge, professionalism, willingness and ability to explain guidelines, changes, updates is impressive. He goes over and above." Read more..

- Toya

"Having just resigned from my previous career, purchased a franchise and relocated to Georgia I was in dire need for a local accountant for my business startup. I interviewed a few accountants.." read more..

- Mark

"Martin with Sanz Virtual Ent has handled my taxes for several years. His professionalism, patience and expertise is unmatched. He assisted me with tax preparation, and estate tax preparation. He clearly.." read more..

- Karen